Elon Musk Follow Triggers PSYOPANIME Price Explosion as Attention Liquidity Returns to Crypto

JUST IN — The crypto market delivered another reminder that attention remains its most powerful short-term catalyst.

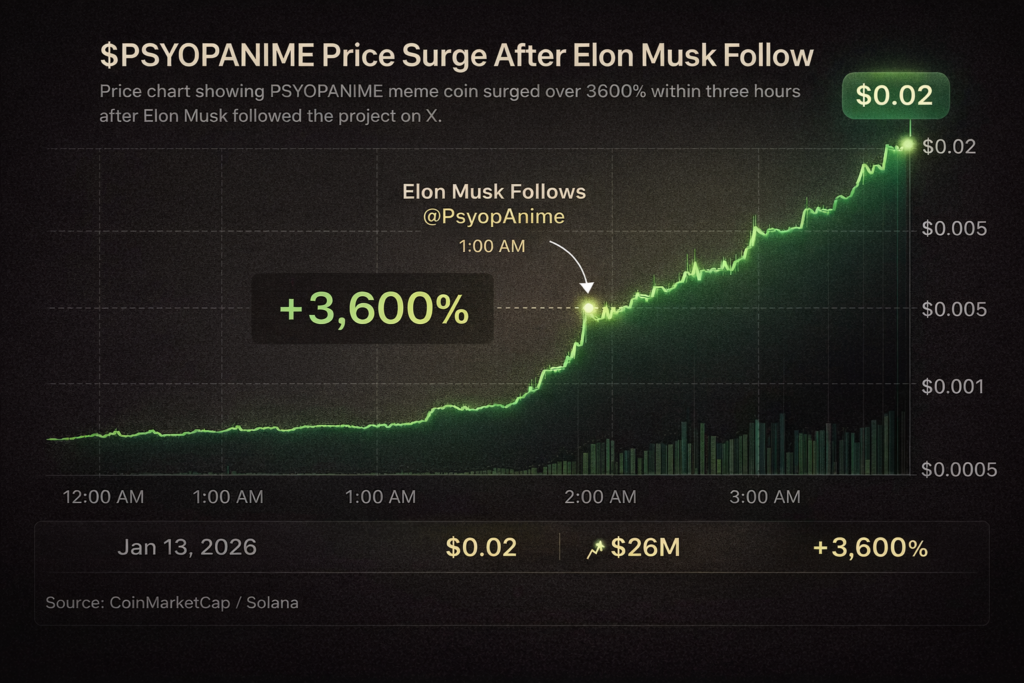

The meme token PSYOPANIME surged over 3,600% within hours after Elon Musk’s X (formerly Twitter) account followed the project’s official profile. With no product update, no roadmap announcement, and no technical breakthrough, price action moved first — and violently.

One follow. One candle. A familiar crypto pattern reappeared.

PSYOPANIME Price Goes Parabolic Within Hours

On-chain and exchange data show PSYOPANIME trading sideways with minimal volume before the social signal. Shortly after Musk’s account followed @PsyopAnime, liquidity flooded in.

Within approximately three hours:

- Price surged ~3,600%

- Market capitalization briefly exceeded $25 million

- Trading volume spiked from near-zero to extreme levels

The move followed a classic low-liquidity breakout structure: thin order books, sudden inflows, and rapid vertical expansion.

Performance Chart: The Elon Musk Effect in Real Time

The chart below highlights the exact moment the social signal occurred and the immediate market reaction.

What stands out is not just the magnitude of the move — but the speed. This was not organic adoption. It was a reflexive liquidity response to attention.

Historically, these patterns tend to compress weeks of price discovery into minutes.

No Endorsement — But Attention Still Moved Markets

It is important to clarify: Elon Musk has not publicly endorsed PSYOPANIME, commented on the project, or promoted the token in any direct way.

However, crypto markets have repeatedly shown that passive social signals — follows, likes, indirect visibility — can act as powerful triggers, especially in meme-driven segments.

In low-cap assets, attention often functions as temporary liquidity.

A Familiar Pattern in Crypto History

This is not new.

Similar short-term price reactions have followed Musk’s interactions with:

- Dogecoin-related assets

- Floki-themed tokens

- Internet-native meme coins across multiple cycles

Each case reinforces the same structural reality: in speculative markets, narrative reach often precedes fundamentals.

Who Benefited — And Who Took the Risk

These moves rarely distribute gains evenly.

Likely beneficiaries:

- Early holders positioned before the social signal

- Fast momentum traders exiting into strength

Highest risk exposure:

- Late retail entrants chasing vertical candles

- Traders assuming sustained upside without liquidity depth

Historically, attention-driven rallies tend to fade once marginal buyers exhaust.

What This Says About the Crypto Market Right Now

The PSYOPANIME move signals something larger than one token.

It suggests:

- Risk appetite remains alive beneath the surface

- Liquidity is reactive, not patient

- Social signals can still overpower fundamentals in the short term

Despite macro uncertainty, crypto continues to reward speed, positioning, and narrative awareness.

Final Take

Crypto hasn’t changed.

Attention is still liquidity.

Liquidity still moves first.

And price still reacts faster than logic.

PSYOPANIME’s surge is less about the token — and more about what happens when visibility collides with thin markets.

The chart exploded.

The lesson remains the same.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. Meme tokens are highly volatile and speculative.

Related readings:

Bitcoin Price Goes Parabolic in Iran as Rial Collapse Triggers Record Local Premium

Crypto YouTube Viewership Falls to Lowest Level Since 2021 — What the Silence Really Signals

Stay Connected with Cryptolaya

For more crypto news, market insights, and in-depth analysis, follow Cryptolaya on social media and stay updated with the latest trends shaping the crypto market.

Follow Cryptolaya:

• Facebook

• Instagram

• X (Twitter)

Pingback: Bitcoin Price in Iran Goes Parabolic as Rial Collapse Triggers Record Premium

Pingback: Crypto YouTube Viewership Hits Lowest Level Since 2021 — What the Silence Signals

Pingback: US Inflation Holds at 2.7%, Reinforcing Sticky Price Pressures